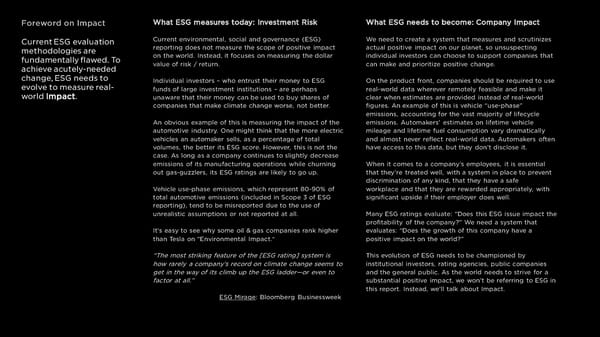

Foreword on Impact What ESG measures today: Investment Risk What ESG needs to become: Company Impact Current ESGevaluation Current environmental, social and governance (ESG) We need to create a system that measures and scrutinizes methodologies are reporting does not measure the scope of positive impact actual positive impact on our planet, so unsuspecting fundamentally flawed. To on the world. Instead, it focuses on measuring the dollar individual investors can choose to support companies that achieve acutely-needed value of risk / return. can make and prioritize positive change. change, ESG needs to Individual investors – who entrust their money to ESG On the product front, companies should be required to use evolve to measure real- funds of large investment institutions – are perhaps real-world data wherever remotely feasible and make it world Impact. unaware that their money can be used to buy shares of clear when estimates are provided instead of real-world companies that make climate change worse, not better. figures. An example of this is vehicle “use-phase” emissions, accounting for the vast majority of lifecycle An obvious example of this is measuring the impact of the emissions. Automakers' estimates on lifetime vehicle automotive industry. One might think that the more electric mileage and lifetime fuel consumption vary dramatically vehicles an automaker sells, as a percentage of total and almost never reflect real-world data. Automakers often volumes, the better its ESG score. However, this is not the have access to this data, but they don’t disclose it. case. As long as a company continues to slightly decrease emissions of its manufacturing operations while churning When it comes to a company’s employees, it is essential out gas-guzzlers, its ESG ratings are likely to go up. that they’re treated well, with a system in place to prevent discrimination of any kind, that they have a safe Vehicle use-phase emissions, which represent 80-90% of workplace and that they are rewarded appropriately, with total automotive emissions (included in Scope 3 of ESG significant upside if their employer does well. reporting), tend to be misreported due to the use of unrealistic assumptions or not reported at all. Many ESG ratings evaluate: “Does this ESG issue impact the profitability of the company?” We need a system that It’s easy to see why some oil & gas companies rank higher evaluates: “Does the growth of this company have a than Tesla on “Environmental Impact.” positive impact on the world?” “The most striking feature of the [ESG rating] system is This evolution of ESG needs to be championed by how rarely a company’s record on climate change seems to institutional investors, rating agencies, public companies get in the way of its climb up the ESG ladder—or even to and the general public. As the world needs to strive for a factor at all.” substantial positive impact, we won’t be referring to ESG in this report. Instead, we’ll talk about Impact. ESG Mirage: Bloomberg Businessweek 2

Tesla 2021 Impact Report Page 1 Page 3

Tesla 2021 Impact Report Page 1 Page 3